When I was young, once or twice a year my father would empty out the large wooden box where he threw his spare change every day, and together we would roll pennies, dimes, nickels, and quarters into neat, uniform cylinders and take them to the bank. I was always astonished at how much money the discarded change would add up to — it was a great, childhood example of a penny saved is a penny earned. When I thought I might do the same now that my kids are school age, I realized there’s just not much change to count. Almost every financial transaction I make is virtual — debit cards, Venmo, Apple Pay. I found myself wondering how on earth will they learn the value — or the weight, in coins — of a dollar?

These days, parents can put allowance on a child’s debit card with just a couple taps on a smartphone — no cash necessary. Easy, right? But how do we teach kids about money and all that it represents? These financial literacy books for tweens and teens can help.

-

Books for Kids and Teens

-

Priceless Facts about Money

Available from:Learn weird yet useful facts about money from financial expert Mellody Hobson. If you’ve ever wondered how humans started using money or where credit ratings and ATMs came from, this book has answers. Readers will learn about the banking system, how money works, and financial terms everyone should know.

Also available from: -

Get To Know: Money

Available from:As money and finances move into the digital era, parents and educators need to adjust how they teach children about it. This book is an excellent resource to help children learn about earning and budgeting money, using a bank account, and understanding cryptocurrency. It’s a must-have for teaching children financial literacy.

Also available from: -

Show Me the Money: Big Questions About Finance

Available from:Alvin Hall grew up in severe poverty in the Florida panhandle — then became a world-renowned financial trainer, expert, and author. In Show Me the Money, Hall shares his no-nonsense approach to money matters, including how the financial, business, and economic sectors of our society work.

Also available from: -

Rebel Girls Money Matters

Available from:This interactive book gives kids a hands-on learning experience. It uses quizzes, stories, and advice from experts and other kids to teach readers about money. Young readers will learn about earning, saving, and spending their money wisely.

Also available from: -

Dollars & Sense: A Kid’s Guide to Using — Not Losing — Money

Available from:Kirkus calls Dollars & Sense “a sporty guide to the wide, weird world of money.” Indeed, this book covers basic economic concepts like supply and demand and inflation as well as the circumstance that led to the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Also available from: -

Paying for College, 2025

Available from:If your teen plans to attend college, you should prepare for its financial obligations. This book will help you and your teen plan for college, maximize the money you can get, and minimize your costs. It takes readers through the FAFSA application line by line, with helpful advice and instructions.

Also available from: -

DK Eyewitness Books: Money

Available from:This one’s about money itself — the various coins and banknotes from countries around the world, and throughout history. Author Joe Cribb is what they call a numismatist, or a currency expert, and was the former “Keeper of Coins and Medals” at the British Museum.

Also available from: -

The History of Money

Available from:This book is an excellent resource to help kids learn about money, its history, why we use it, and how it works. It takes readers through the ages and stages of how money became necessary and teaches them about interest, banks, and taxes.

Also available from: -

Careers

Available from:When you’re making plans for the future, it helps to be informed. Choosing the right career is one of the most essential choices a young person makes, and it impacts their finances for the rest of their life. This book walks teens (and other interested parties) through hundreds of career options and their requirements.

Also available from: -

Heads Up Money

Available from:For older teens with a basic understanding of money matters — how and why to save, the difference between wants and needs — there’s Heads Up Money. This book goes beyond “What is money?” to more prescient and timely questions like “What is the wage gap?” and discusses economic theories. It’s a big-picture view of money and its role in our modern world, rather than a personal finance how-to.

Also available from: -

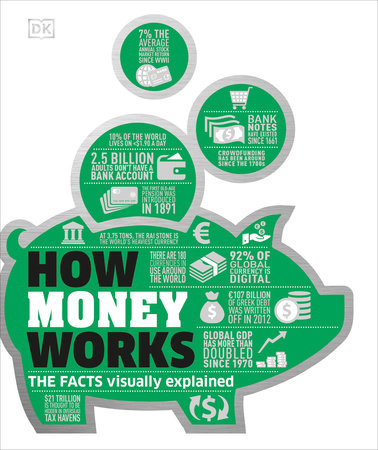

How Money Works: The Facts Visually Explained

Available from:For the visual learner who is interested in complex financial information, How Money Works will be indispensable. Facts and stats pepper the entire book — part of the How Things Work series — and help break down complex topics, like asset allocation and diversification (which I’ve never really understood).

Also available from: -

What Color Is Your Parachute? for Teens, Fourth Edition

Available from:Help your teen design a future they love with help from this book by career strategist Carol Christen. With advice on finding the best career for your strengths and financial needs, tips for successful interviews, and advice on navigating the modern job market, it is an invaluable resource for any young person.

Also available from: -

More Money, Please: The Financial Secrets You Never Learned in School

Available from:This is Money Management 101 for those who have recently left the nest, written by someone in their shoes. But not just anyone. At just 17, Scott Gamm created HelpSaveMyDollars.com — and quickly became a financial news commentator. He wrote this book in 2013 while he was still at the New York University Stern School of Business.

Also available from:

You might also like:

- Books That Teach Life Skills to Tweens

- What To Do If Your Child Is Interested in Books With Mature Themes

- 8 Great Resources for Teaching Kids Financial Literacy

Editor’s Note: This article was originally published in 2018 and updated in 2025.