Why It’s Never Too Early to Teach Your Kids Financial Literacy

by Cinders McLeod

I became committed to children’s financial literacy during the 2007 – 08 financial crisis. I was working for a national newspaper and noticed increased awareness of the importance of teaching kids about money. So, truth out: I don’t have a traditional degree in economics. I am a political cartoonist. But money is political, and the joy of cartoons is that they capture the essence of a crisis with an economy of words and pictures. With this skill in hand, and my own experience as a single mother, cartoonist, and freelancer (a homemade degree in economics), I created the Moneybunny series of picture books for young children.

I wanted my books to focus on the idea of money. I was fascinated in art college with the lessons of semiology: sign = signifier and signified. If you look at money as the sign, the signifier doesn’t have to be dollars — it can be virtual money or tokens or even carrots. That’s why I used the international currency of carrots. I wanted to get away from nickel-and-diming and focus on the big concepts with a currency that could cross borders. And I wanted to put these basic financial principles in place at a young age to better equip children when they move into the digital world.

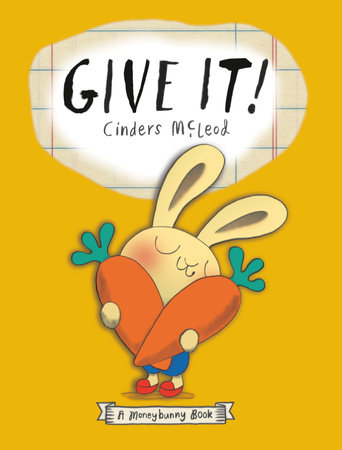

The order of the four Moneybunny books — Earn It!, Spend It!, Save It!, Give It! — is intentional, and with each book, the dedication reveals its title’s teachings: pride and independence, choice and wisdom, planning and patience, and love and gratitude.

First lesson first: we have to have money before we can do anything with it (I can see you smirking!). This is a tricky lesson to teach because one has to be respectful of how different families work. Some families believe it’s okay to teach the concept of earning by paying their children for the jobs they do in the home. Others feel all home work goes toward the good of the family and shouldn’t be monetized. And some linger somewhere in between: jobs like cleaning one’s room aren’t monetized, but jobs above and beyond are. I like that place because it teaches responsibility and love.

These considerations aside, if you’d rather not raise entitlement bandits, best to teach your wee ones that money must be earned; it doesn’t just magically appear from a hole in the wall or a handbag. In Earn It!, Bun thinks she wants to be rich famous. Will that happen overnight? No! She’ll have to earn it. Bonus lessons include delayed gratification and personal responsibility.

The main lesson in Spend It! is that spending is about making choices dependent on how much we have, if we live within our means (Charge It! has yet to be written!), and what’s really important to us. I think that last bit is really special and something that Sonny in Spend It! works out: having to choose helps define who we are. Parameters are important. They help keep us together.

In Save It!, Honey works out how to create a budget and make her dream come true without missing out on simple pleasures. And in Give It!, Chummy learns the value of giving. I can’t reveal too much about these two books until they grace the shelves, but that’s the gist — and the wait will be worth it!

Most financial gurus agree the best way of teaching these lessons is with receptacles labeled accordingly. I like recycled glass jars because they teach children to be careful with money and care for the environment. The advantage of glass jars over piggy banks is that young, pre-abstract-thinking children (under 6 – 10) can see their money grow — or shrink. When they’re ready, they’ll cross the bridge from jars to youth bank accounts, paper to digital. And then, with hope, when they tap into those accounts, they’ll understand those are their real, hard-earned dollars that are disappearing.

Are these four traditional lessons still relevant in a digitally-driven economy with credit cards and online purchases? Oh yes, and more so! If kids don’t grasp these ideas when they’re young, they’ll soon flounder like astronauts cut loose in cyberspace. Because here’s the bad news: Our children live in a tougher world with homes priced out of hand, jobs sought with little hope, and accounting made more complicated with digital additions. Lesson number most-important? If we aren’t on top of our finances, our finances are on top of us.

But here’s the good news: Some lessons come in humorous and colorful picture books — because we really don’t want to terrify our little bunnies. These lessons will be gently planted, waiting to blossom into a greater awareness that will help guide them for the rest of their lives.

For free resources (including jar labels and a private money diary), sneak peeks, and more, visit my blog at Moneybunnies.com!

-

Get the Books:

-

Earn It!

Preorder from:

Save It!

Preorder from: